Community Survey Result 2024

This article is very long and contain a few visualizations. For better reading experience, please read this article in wider screen.

Foreword

This is the first time I am running survey for Tokyo Afterschool Summoners (Housamo), and already have achieved 686 responses, that is quite impressive!

Thank you to those who have helped me spread the word on various social media platforms! I am also very glad that this survey caught the attention to more people from the Japan community, so we can analyse the data in more angles now.

Respondent Profile

Source of respondents

Majority of the respondents found the survey via Discord, 巴哈姆特 (a Taiwan game forum) and X (Twitter).

There was one person who “found the survey” from Google Play Store (?!)

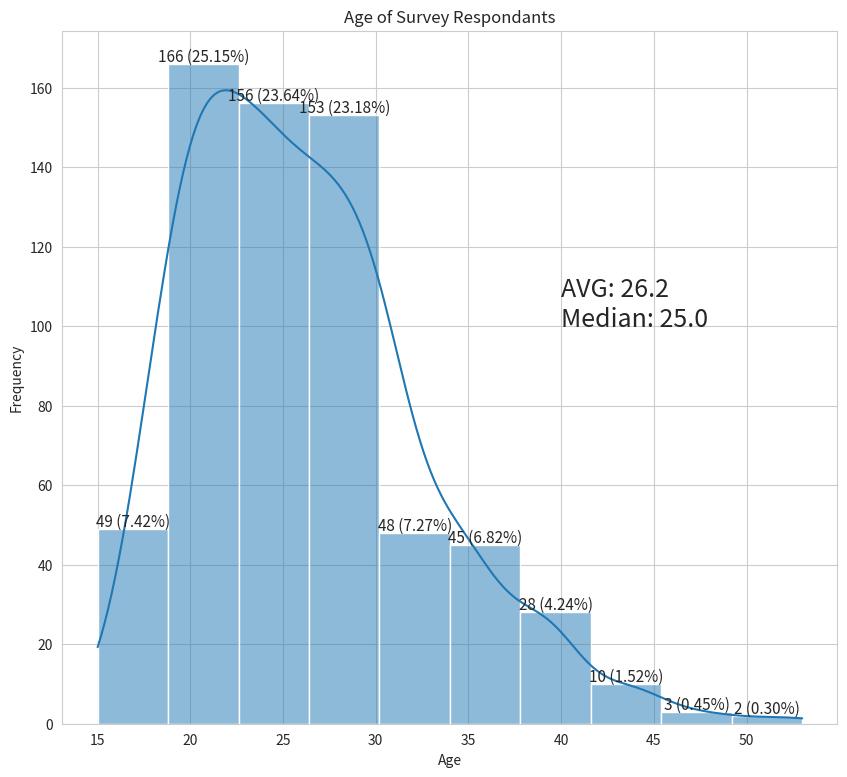

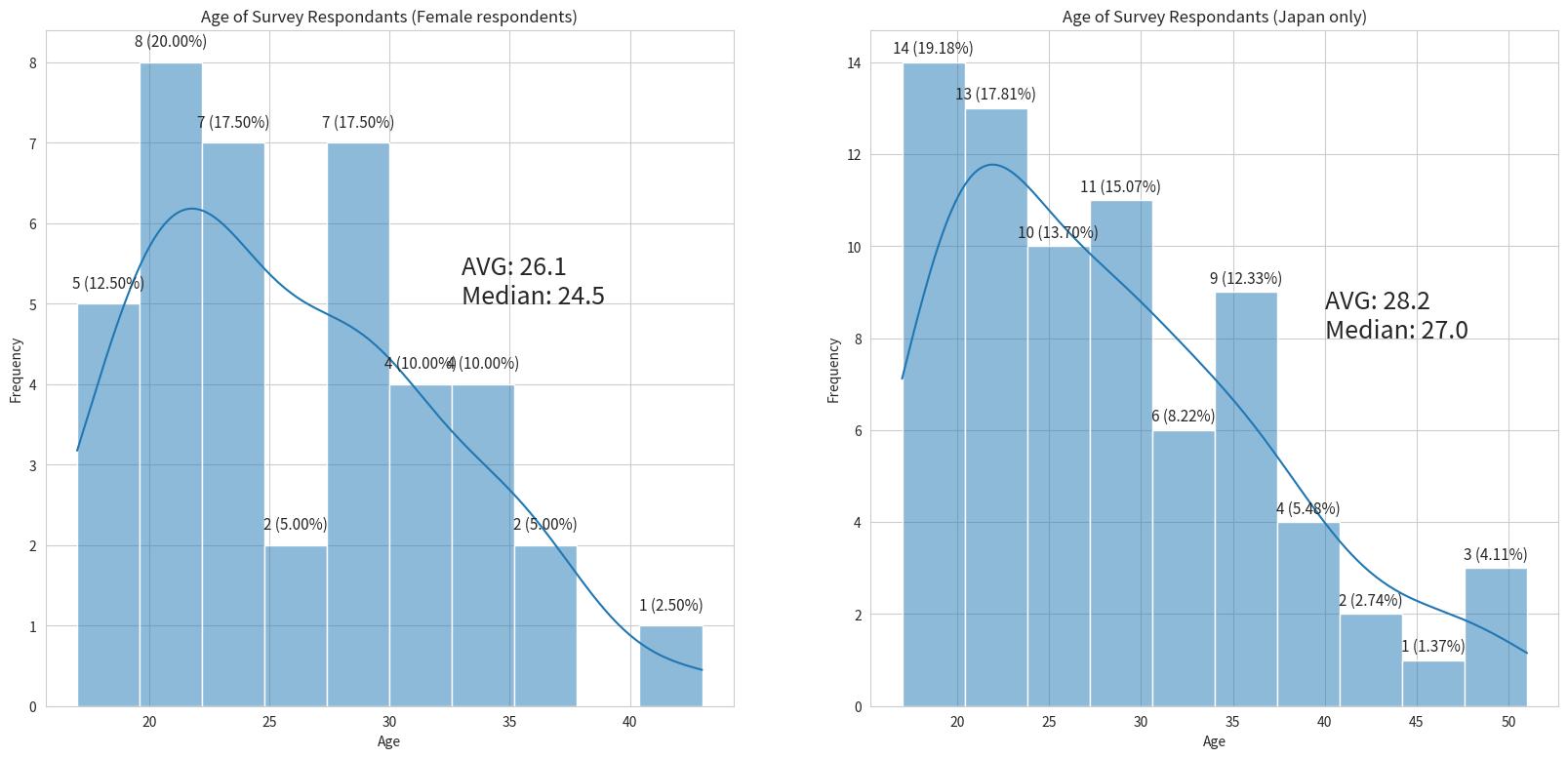

Age

Since this is a mobile gacha game, it is no surprise that the age distribution is skewed towards the younger side.

The youngest is 15 years old, and the oldest is 53 years old.

Gender

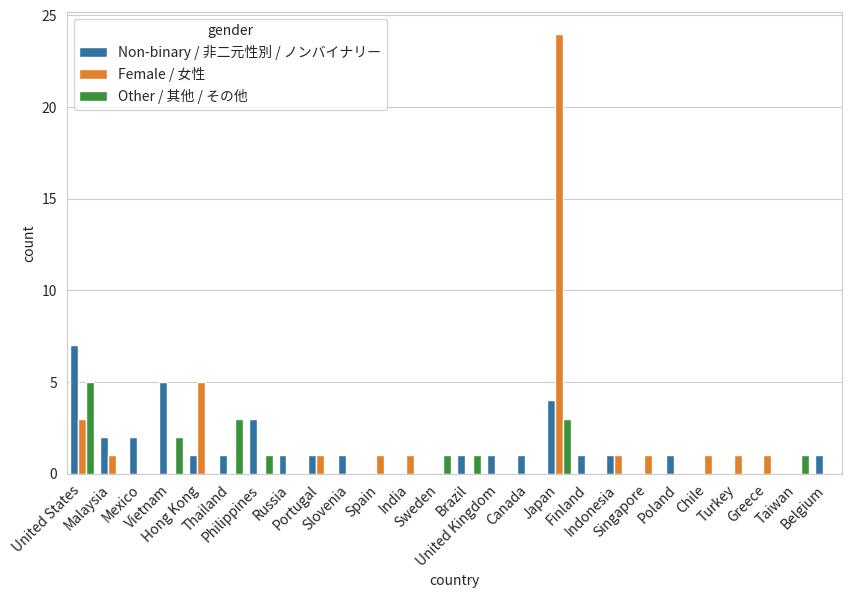

13.6% of the respondents are non-male and 5.4% are transgender.

Female/Non-Binary/Other Respondents and Where to Find them

Majority of our female respondents come from Japan (24 out of 41). Keep this in mind when viewing the female-only and Japan-only charts later on.

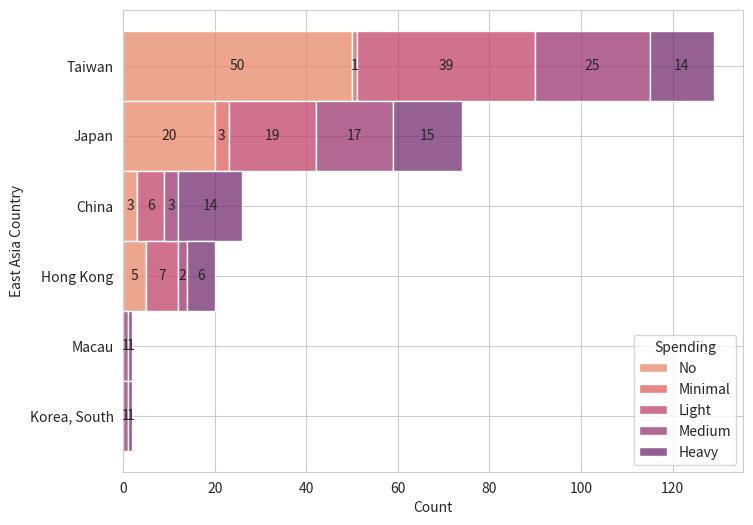

Country

Top 3 countries are Taiwan (129), United States (127) and Japan (76).

It is clear that East Asia is the most important market for the game (being culturally close to Japan), followed by Southeast Asia and North America.

| Region | Country of birth / 出身国 | Count | Percentage |

|---|---|---|---|

| East Asia (37.17%) | Taiwan | 129 | 18.80% |

| Japan | 76 | 11.08% | |

| China | 26 | 3.79% | |

| Hong Kong | 20 | 2.92% | |

| Macau | 2 | 0.29% | |

| Korea, South | 2 | 0.29% | |

| North America (24.20%) | United States | 127 | 18.51% |

| Mexico | 22 | 3.21% | |

| Canada | 9 | 1.31% | |

| Guatemala | 2 | 0.29% | |

| El Salvador | 2 | 0.29% | |

| Puerto Rico | 1 | 0.15% | |

| Panama | 1 | 0.15% | |

| Dominican Republic | 1 | 0.15% | |

| Cuba | 1 | 0.15% | |

| Southeastern Asia (19.68%) | Philippines | 37 | 5.39% |

| Vietnam | 35 | 5.10% | |

| Indonesia | 25 | 3.64% | |

| Malaysia | 22 | 3.21% | |

| Thailand | 8 | 1.17% | |

| Singapore | 7 | 1.02% | |

| Brunei | 1 | 0.15% | |

| Europe (9.04%) | United Kingdom | 8 | 1.17% |

| Russia | 7 | 1.02% | |

| Portugal | 6 | 0.87% | |

| Spain | 5 | 0.73% | |

| France | 5 | 0.73% | |

| Finland | 5 | 0.73% | |

| Poland | 4 | 0.58% | |

| Germany | 3 | 0.44% | |

| Belgium | 3 | 0.44% | |

| Sweden | 2 | 0.29% | |

| Netherlands | 2 | 0.29% | |

| Italy | 2 | 0.29% | |

| Ireland | 2 | 0.29% | |

| Greece | 2 | 0.29% | |

| Slovenia | 1 | 0.15% | |

| Slovakia | 1 | 0.15% | |

| Romania | 1 | 0.15% | |

| Monaco | 1 | 0.15% | |

| Lithuania | 1 | 0.15% | |

| Bulgaria | 1 | 0.15% | |

| South America (7.00%) | Brazil | 29 | 4.23% |

| Chile | 6 | 0.87% | |

| Argentina | 5 | 0.73% | |

| Venezuela | 2 | 0.29% | |

| Ecuador | 2 | 0.29% | |

| Uruguay | 1 | 0.15% | |

| Peru | 1 | 0.15% | |

| Colombia | 1 | 0.15% | |

| Bolivia | 1 | 0.15% | |

| Oceania (1.02%) | Australia | 4 | 0.58% |

| Vanuatu | 1 | 0.15% | |

| New Zealand | 1 | 0.15% | |

| French Polynesia | 1 | 0.15% | |

| Western Asia (0.87%) | Turkey | 3 | 0.44% |

| United Arab Emirates | 1 | 0.15% | |

| Saudi Arabia | 1 | 0.15% | |

| Israel | 1 | 0.15% | |

| Africa (0.58%) | Reunion | 1 | 0.15% |

| Nigeria | 1 | 0.15% | |

| Angola | 1 | 0.15% | |

| Algeria | 1 | 0.15% | |

| South Asia (0.29%) | India | 2 | 0.29% |

| Central Asia (0.15%) | Kazakhstan | 1 | 0.15% |

Despite the largest expected player base of this game being Japan, this survey still was not able to capture the same proportion of Japanese players (only 76). I just don’t know where these Japanese people are lurking.

China should also be a pretty big player base of this game, but because the survey was conducted via Google Forms, people living in China cannot access Google websites unless they use VPN. It does not mean that there are very few China Housamo players.

Japanese Reading proficiency

59.3% of the respondents cannot read Japanese at all, this number is much higher than what we observed in Live A Hero survey (31.4%).

97 respondents (14.1%) have N1-level of Japanese reading ability, which are mostly those born in Japan (76).

Less than a quarter of the respondents have Japanese reading ability higher or equal to N4-level.

The Game

Actual Player

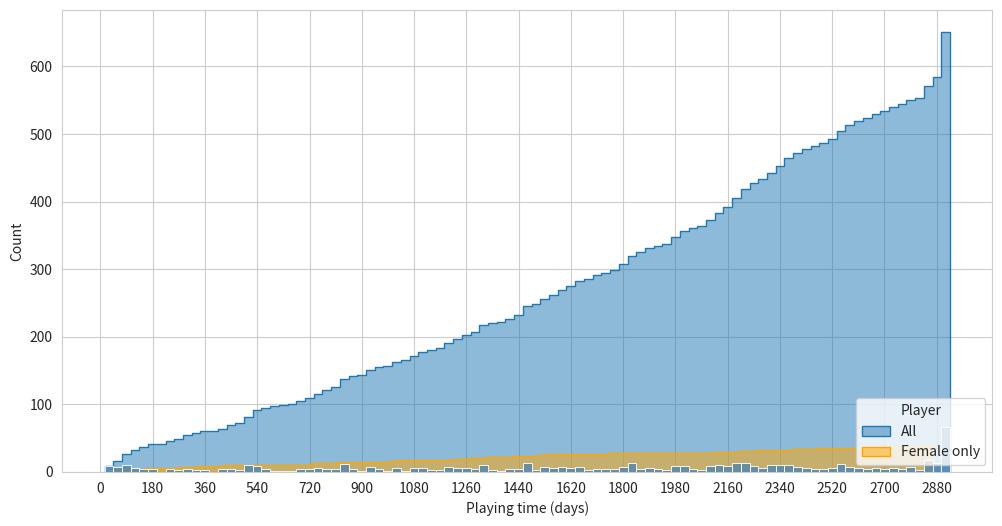

Playing Time

- X-axis is the number of days played (end date is set to 2 Dec 2016).

- The first few month had the fastest user acquisition rate, but it was not as big as what we observed in Live A Hero.

- Since then, the player base seems to be growing at a linear scale.

- Female players seem to always have been around even before LifeWonders really start to advertise in female-focus circles like AGF

Main Character Configuration

![]() Protagonist is the most popular choice, pairing with Toshiyuki Hosaka as the main character’s voice.

Protagonist is the most popular choice, pairing with Toshiyuki Hosaka as the main character’s voice.

| Which MC body type did you choose? 您选择的主角体型? あなたが選んだ主人公の体型は? | |||||||

|---|---|---|---|---|---|---|---|

| What gender do you identify as? 您的性别? あなたの性別は? | Are you Cisgender or Transgender? 您是順性別还是跨性別? あなたはシスジェンダーですか、それともトランスジェンダーですか? | 1 | 2 | 3 | 4 | 5 | Grand Total |

| Male / 男性 | Cisgender / 順性別 / シスジェンダー | 61 | 34 | 212 | 123 | 132 | 562 |

| Transgender / 跨性別 / トランスジェンダー | 1 | 2 | 5 | 3 | 1 | 12 | |

| Female / 女性 | Cisgender / 順性別 / シスジェンダー | 23 | 11 | 3 | 37 | ||

| Transgender / 跨性別 / トランスジェンダー | 2 | 1 | 3 | ||||

| Non-binary / 非二元性別 / ノンバイナリー | Cisgender / 順性別 / シスジェンダー | 2 | 3 | 3 | 11 | 1 | 20 |

| Transgender / 跨性別 / トランスジェンダー | 1 | 3 | 4 | 5 | 13 | ||

| Other / 其他 / その他 | Cisgender / 順性別 / シスジェンダー | 1 | 4 | 2 | 3 | 10 | |

| Transgender / 跨性別 / トランスジェンダー | 2 | 3 | 1 | 6 | |||

| Grand Total | 66 | 69 | 228 | 159 | 141 | 663 | |

Interesting points:

- Female respondents (cis and trans) never choose

Protagonist and

Protagonist and  Protagonist.

Protagonist. - There are cis-male respondents who choose female body types (

Protagonist)

Protagonist) - We have straight male players?!

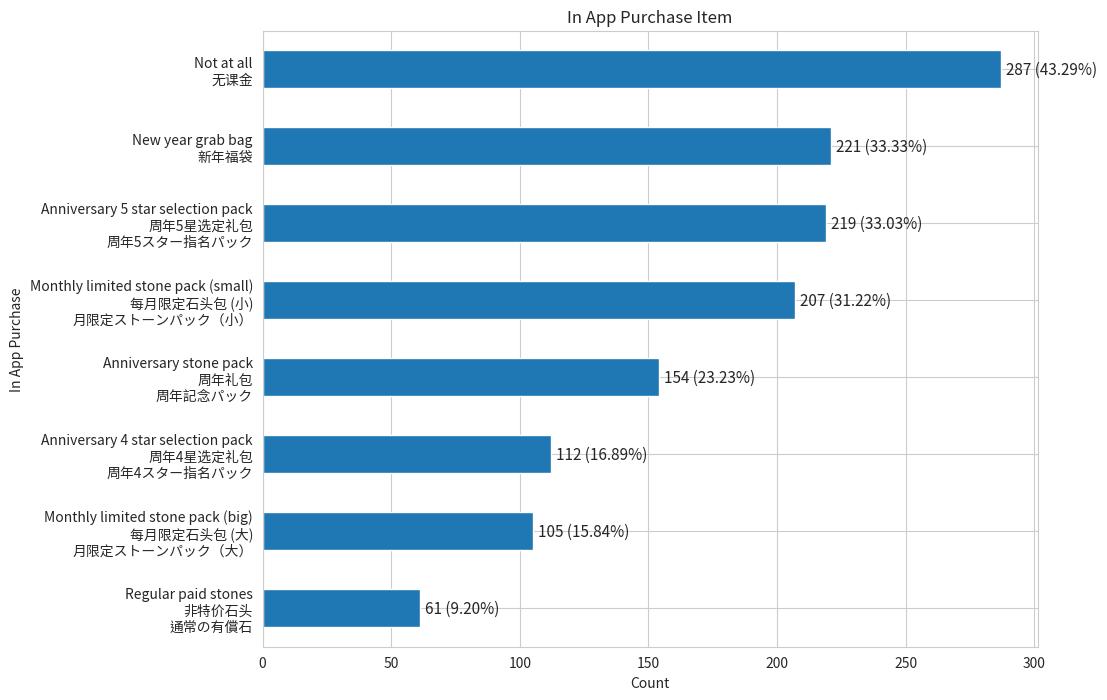

Money spending

- More than 50% of the players actually spend at least some amount of money in Housamo

- “Anniversary 5 star selection pack” and “New year grab bag” are the most popular items

- “Anniversary 5 star selection pack” is much more popular than “Anniversary 4 star selection pack”

I forgot to include the JPY500 beginner pack into the question…

I plan to revamp this question by having options like “No“, “Bought only once”, “Bought < 50% of the times” and “Bought >= 50% of the times” for each in-app purchase item next year.

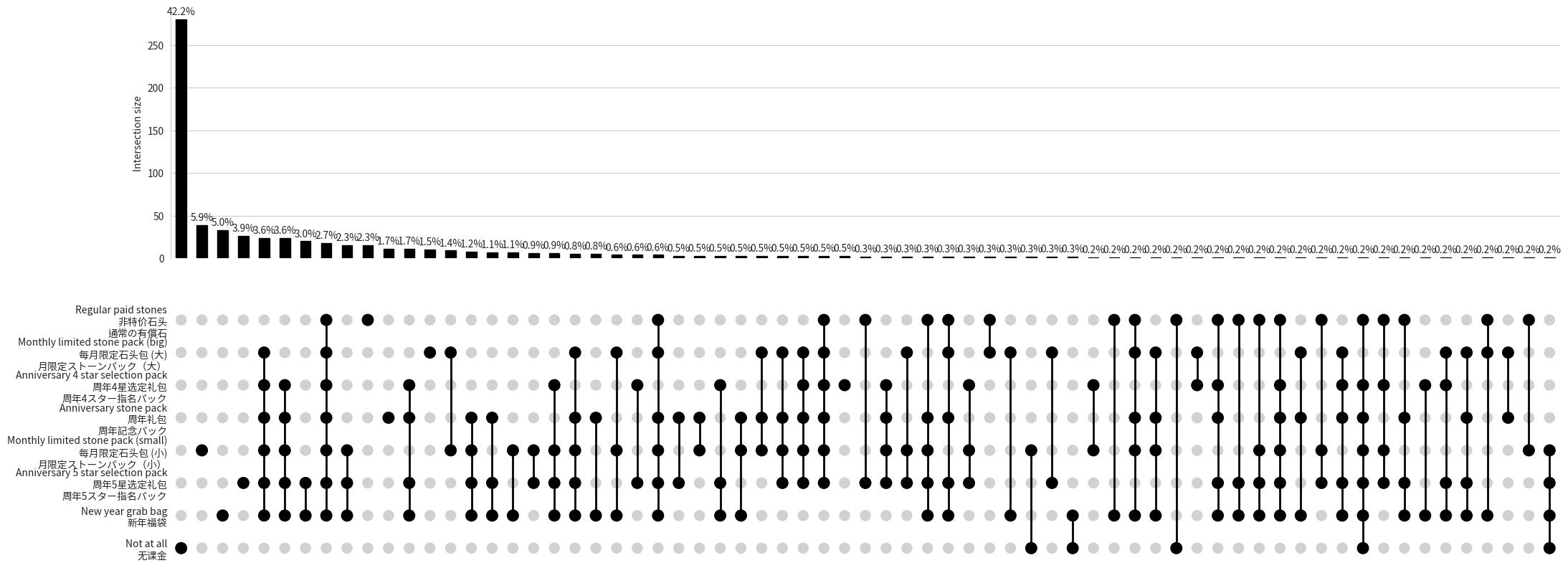

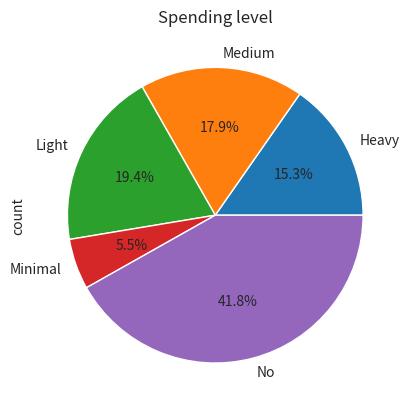

Definition of Spending level

To help make other visualizations easier to understand, we will introduce the concept of spending level here.

- Heavy: those who had bought the “big” monthly stone pack

- Medium: those who had bought the “small” monthly stone pack

- Because the question did not ask how often people bought stone packs, it is hard to further differentiate “those that buy stone pack(s) in every event” vs “those that only spend once or twice in their entire experience”.

- Light: those who only bought the anniversary pack and/or new year grab bag (i.e. spent only once or twice a year)

- Minimal: none of the above but at least still spent some money in the game

- No: never spent a single cent in this game

The criteria for each spending level may be a little arbitrary, but it is enough to get a sense of the general trend.

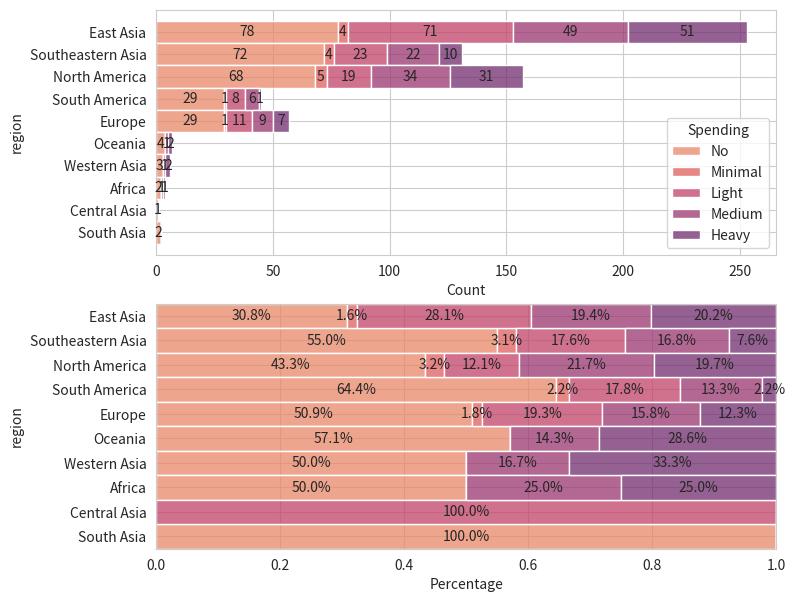

East Asia has the highest percentage of Housamo players that spend money in-game. Given that, you can see why LifeWonders advertise a lot to East Asia countries like Taiwan.

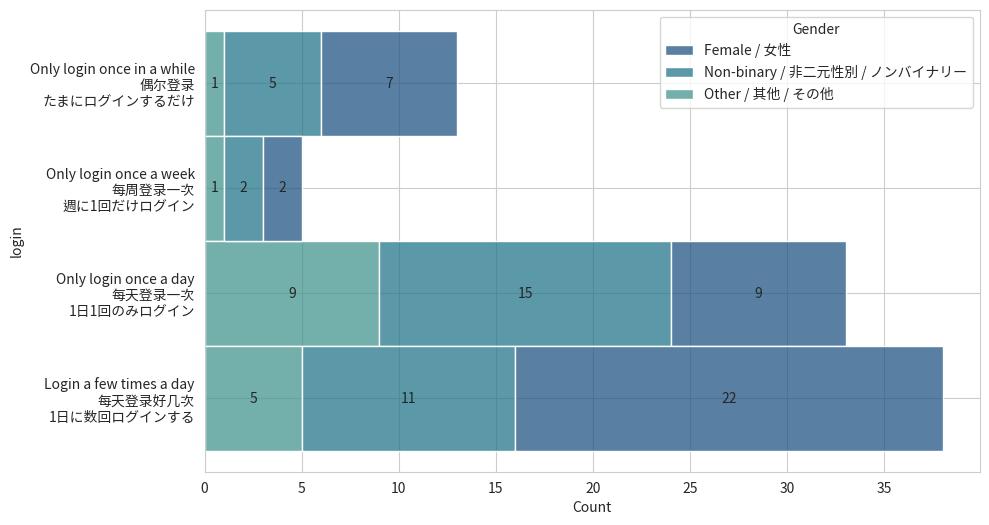

Gameplay Style

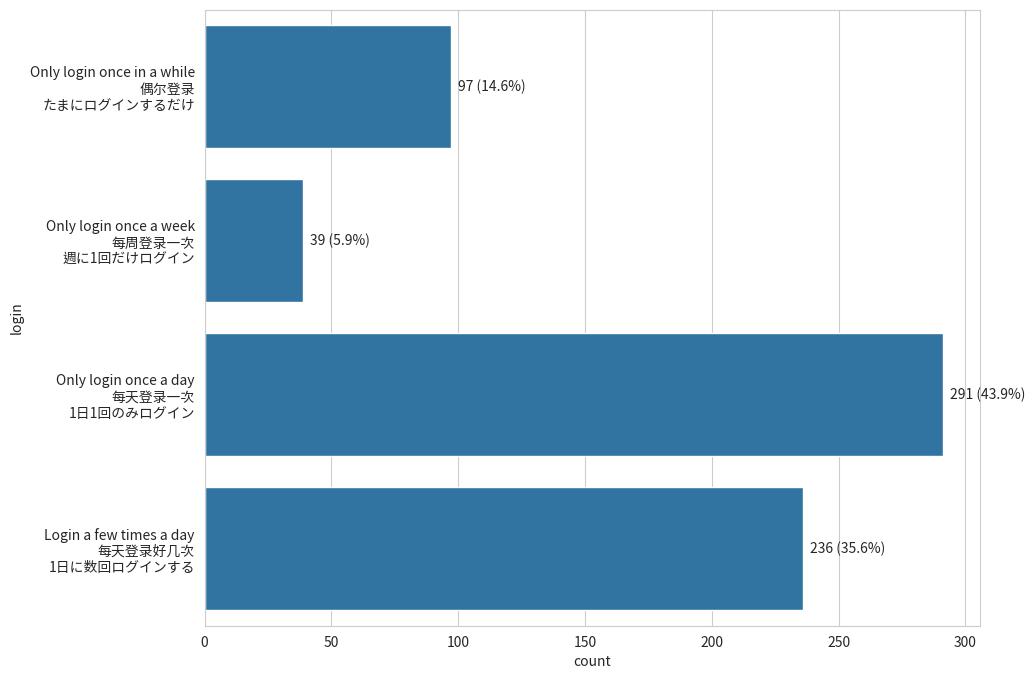

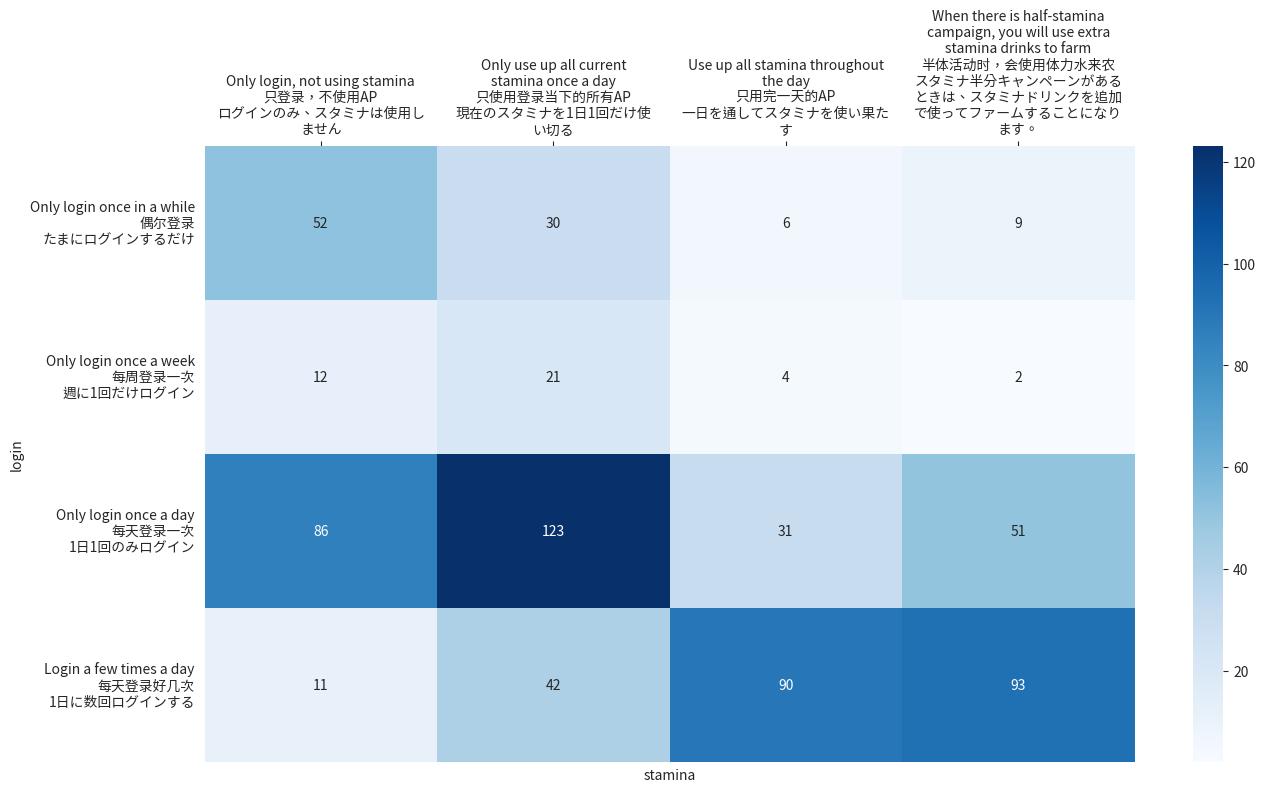

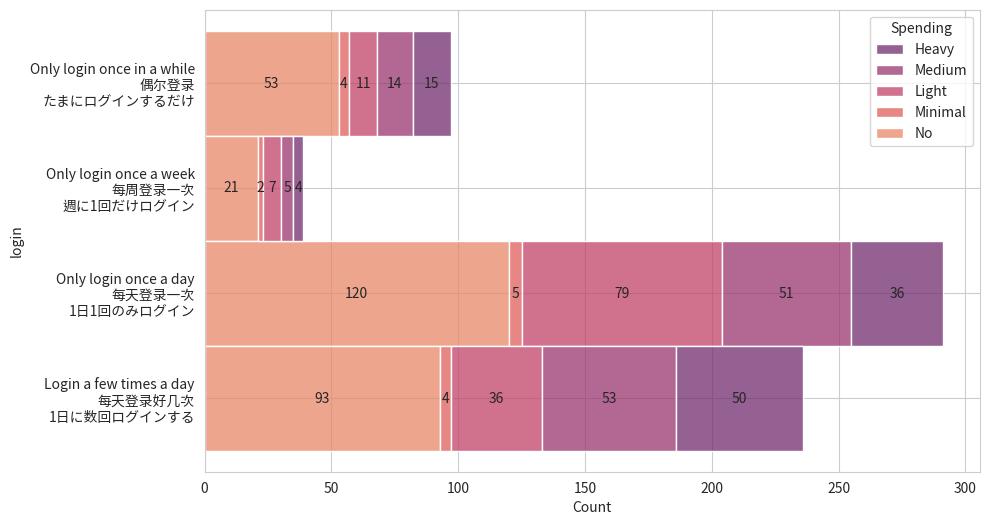

- Nearly 80% of the players login at least once a day.

- Only 43% of the players will make sure all AP are used.

- Only 23% of the players put in more time to farm half-stamina campaigns

- Those who play the game in the most earnest way (last tier) are more likely to be paying customer too.

The main takeaway is, players can enjoy the game in various ways. There are paying players in every tier of gameplay style. The game will do well by balancing the needs for both casual and hardcore players.

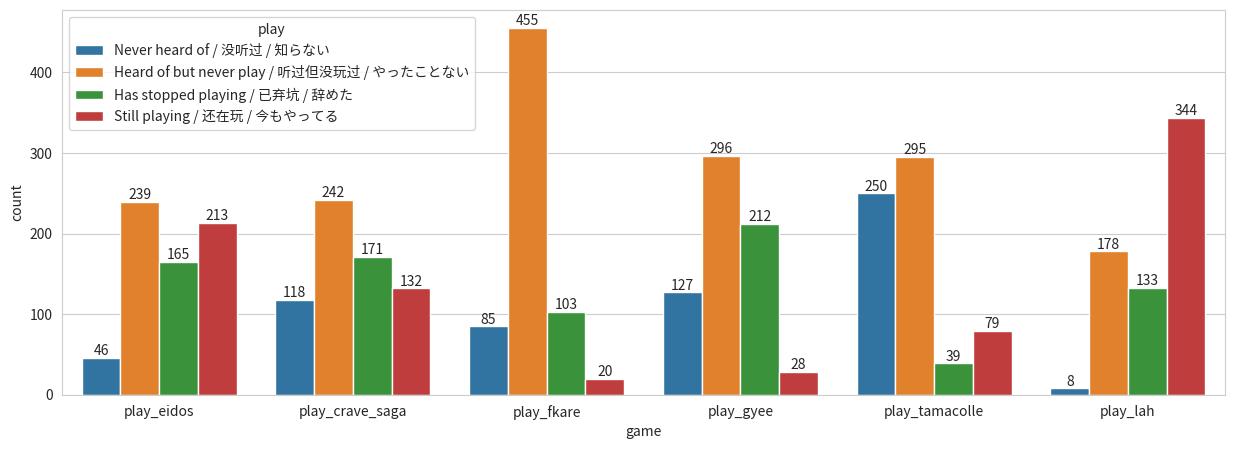

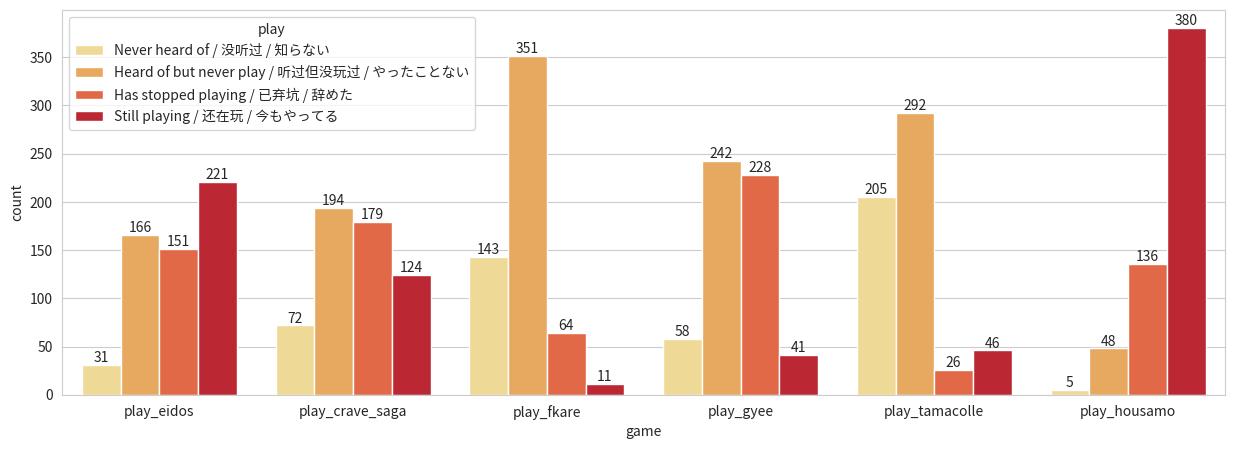

Other games

For all games other than Live A Hero, the trend look very similar to the same questions I made on Live A Hero Community Survey 2024 (see diagram below).

- The percentage of “current Housamo players but never try Live A Hero” is much higher than “current Live A Hero players but never try Housamo”.

- This could be because Live A Hero is still not officially translated after 4 years. Whereas it is easier for oversea Live A Hero players to pick up Housamo because Housamo at least has some official translation.

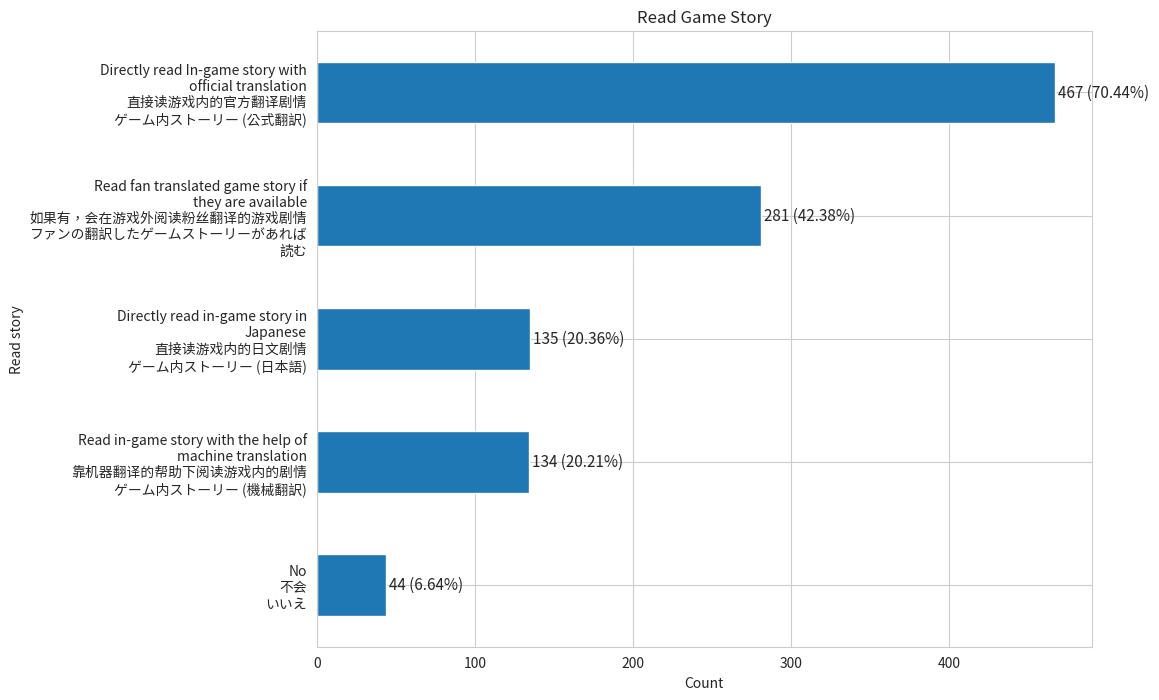

Read story

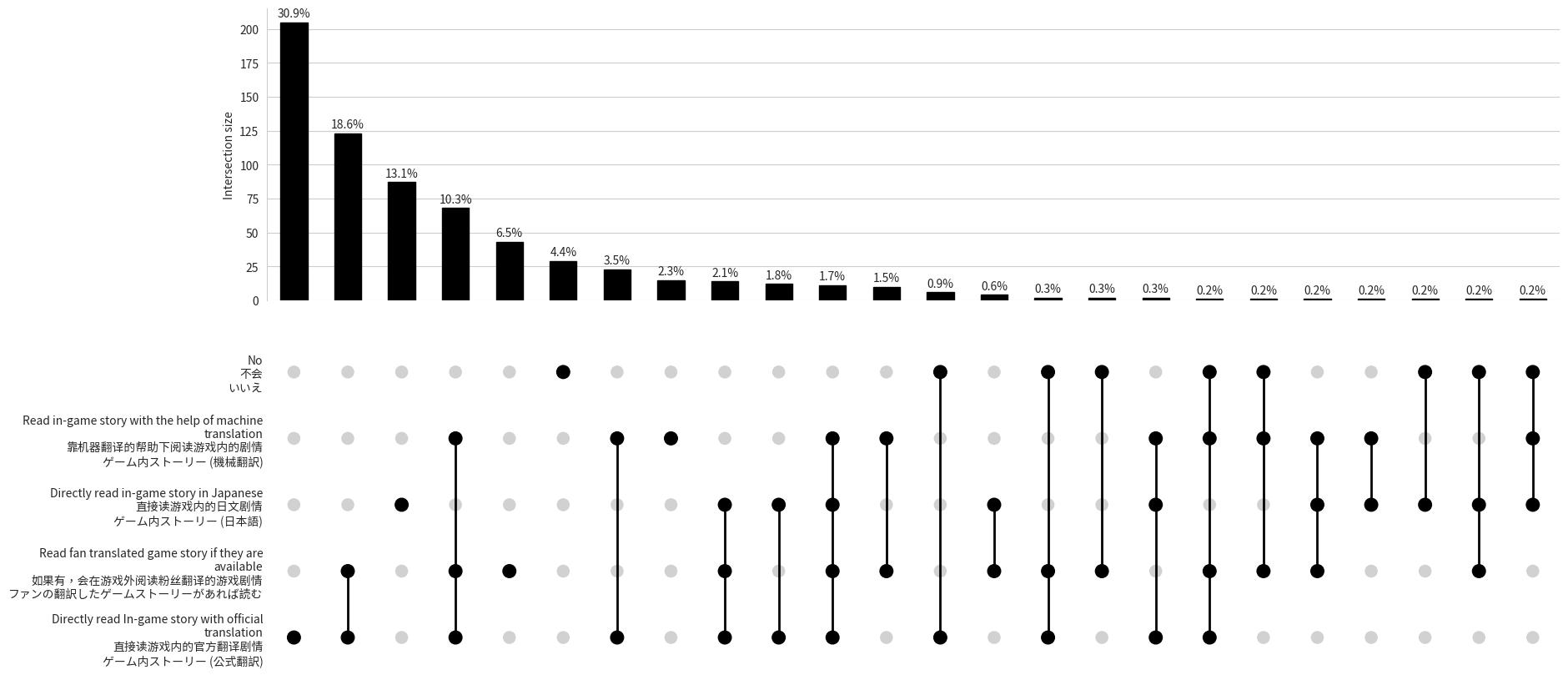

Based on the UpSet Plot, we can observe that:

- 30.9% of the respondents fully rely on official translation

- Another 18.6% of the respondents read official translation and fan translation when available

- Only 13.1% of the respondents can read game story in Japanese directly

- Then there are 10.3% of the respondents even go as far as using machine translation to read game story, when official/fan translation are not available

Story Rating

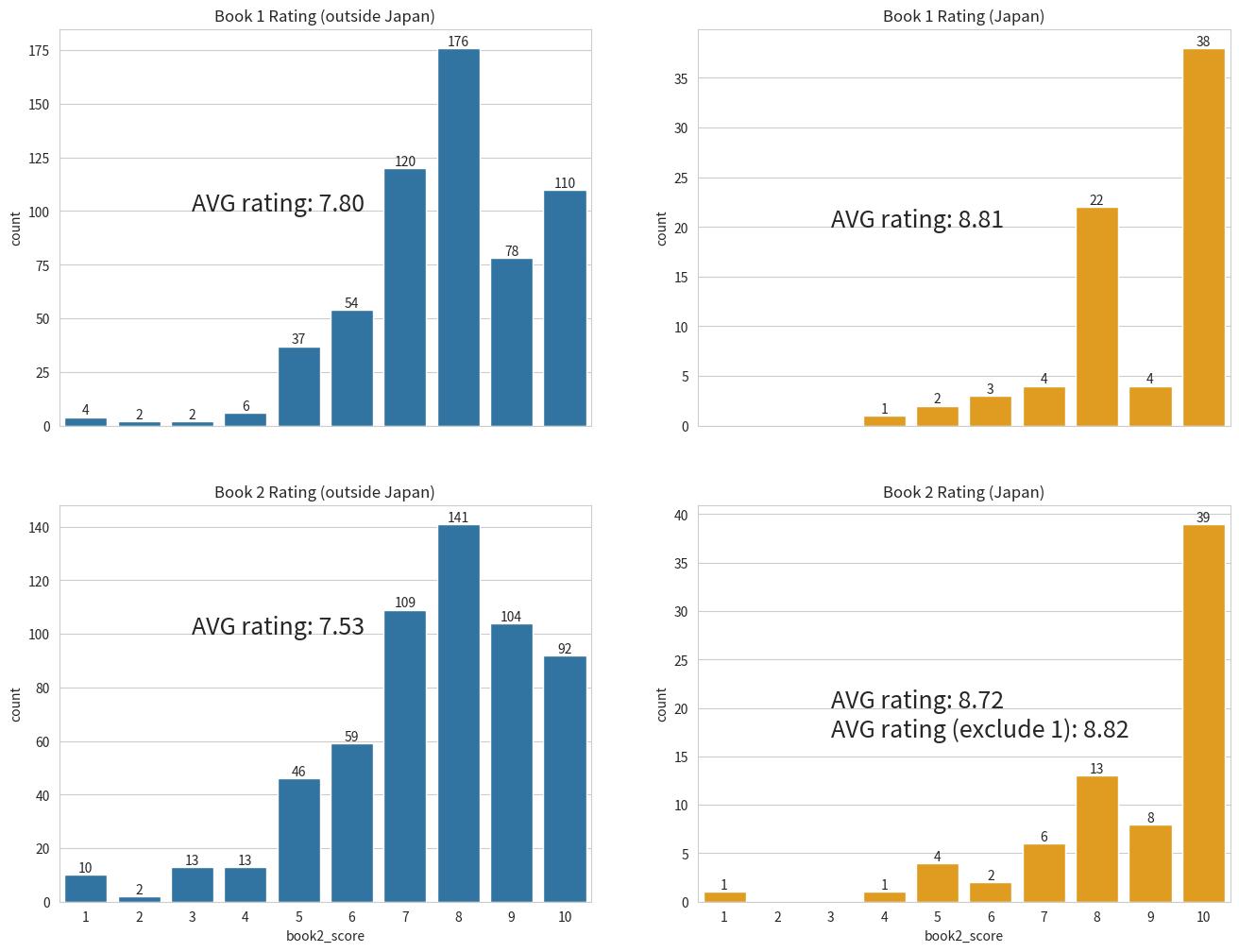

- Global respondents tend to rate Main Quest Book 1 story a bit higher than that of Book 2 story.

- If we exclude the one Japanese respondent that rate Main Quest Book 2 story as “1”, then Japanese respondents generally rate Book 2 higher than Book 1.

- The average story rating from Japan respondents’ is also slightly higher than from global respondents

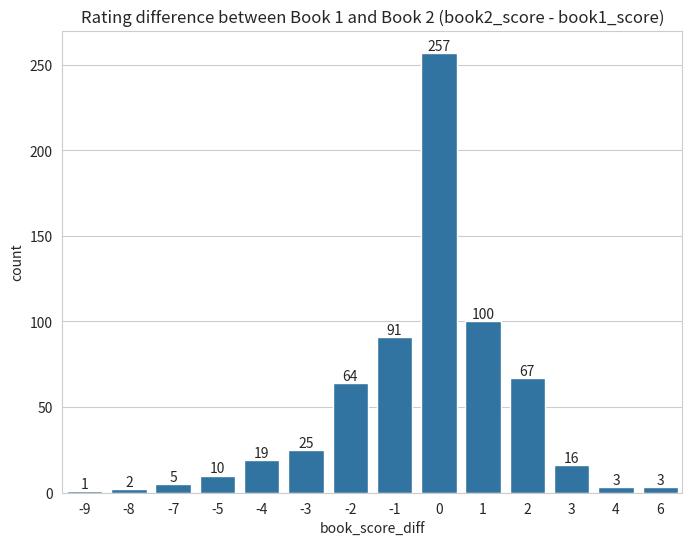

The rating gap between book 1 and book 2 for a single respondent forms a bell curve, with most people giving the same score for book 1 and book 2. However, we can also see that there are people who like book 2 so much that they give book 2 extra 6 stars. There are also people who give book 1 “10 stars” and book 2 “1 star” (i.e. -9 gap).

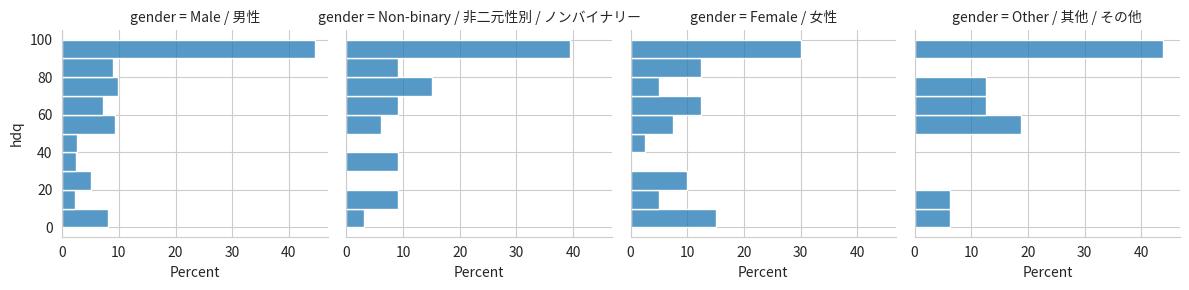

High Difficulty Quest

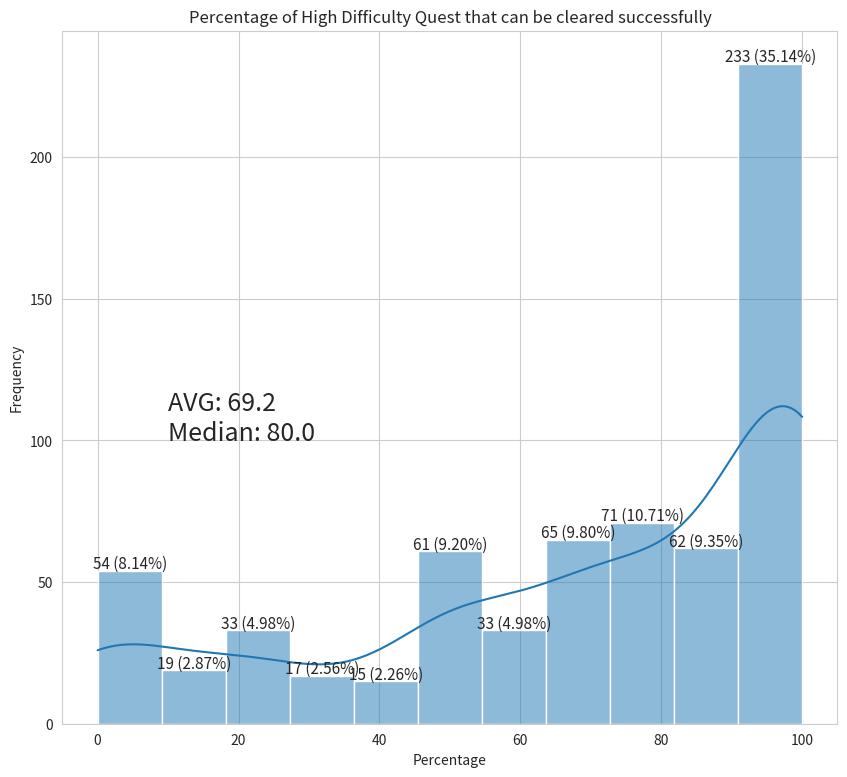

More than half of the respondents report that they can clear 80% of the High Difficulty Quests.

It seems that slightly more female respondents struggle to clear High Difficulty Quests compared to other gender groups. LifeWonders might want to take note of this if they want to expand more on female market.

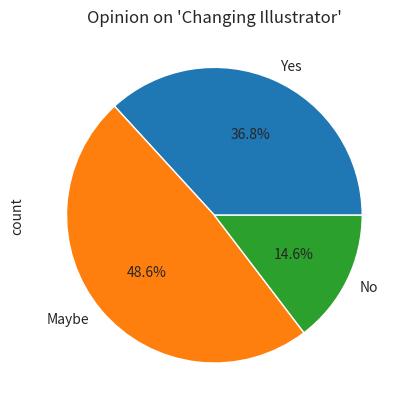

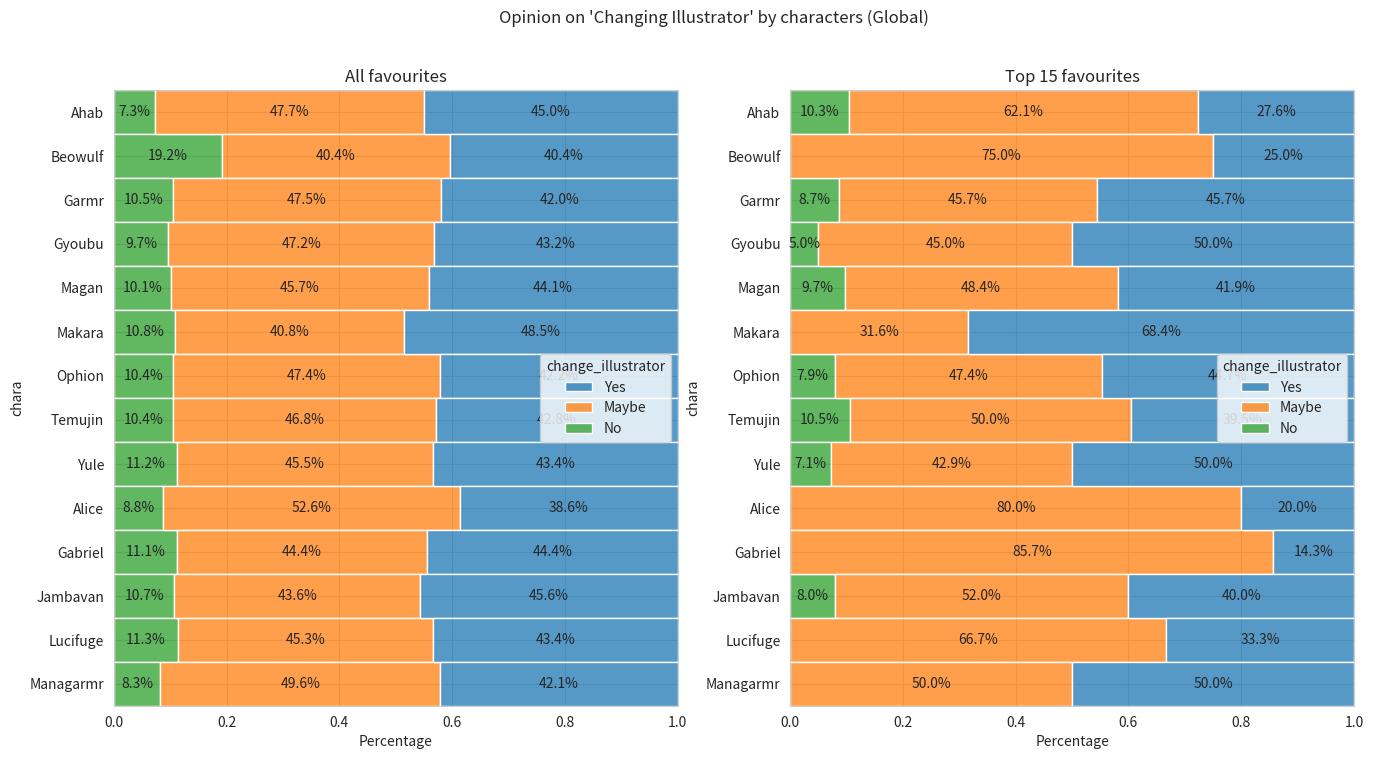

Changing Illustrators

Only 14.6% of the respondents are very opposed to the idea of original illustrator of a character being replaced by someone else, with almost half of the respondents choosing “Maybe”.

I believe some people may have guessed why I ask this question when they saw it. Those who have played Housamo for a long time would have noticed that some old-time characters almost never get new arts for some unknown reason. Therefore, I selected a few characters to see if people who like these characters have slightly different opinion about “changing illustrator”.

For the “All favourites” characters, the percentage of those choosing “Yes” are almost all higher than 40%, and less than 12% chose “No”. The only outlier is ![]() Beowulf, which has 19.2% of the respondents opposing the idea of changing illustrator (higher than the global 14.6%)

Beowulf, which has 19.2% of the respondents opposing the idea of changing illustrator (higher than the global 14.6%)

When we look at the “Top 15 favourites” characters chart, the data is even more dramatic. The percentage of respondents who said “No” are sometime exactly 0%. Those who chose ![]() Makara as one of their “Top 15 favourites” overwhelmingly support the idea of changing illustrator (68.4%)!

Makara as one of their “Top 15 favourites” overwhelmingly support the idea of changing illustrator (68.4%)!

In case LifeWonders think that they cannot afford to offend the Japanese audiences, here is the same chart with Japan-only data (the fluctuation is bigger because Japan data is smaller in this survey):

![Opinion on 'Changing Illustrator by certain characters (All favourites vs Top 15 favourites) [Japan only]](/assets/img/survey-2024/change-illust-chara-jp.jpg)

Character popularity

Global

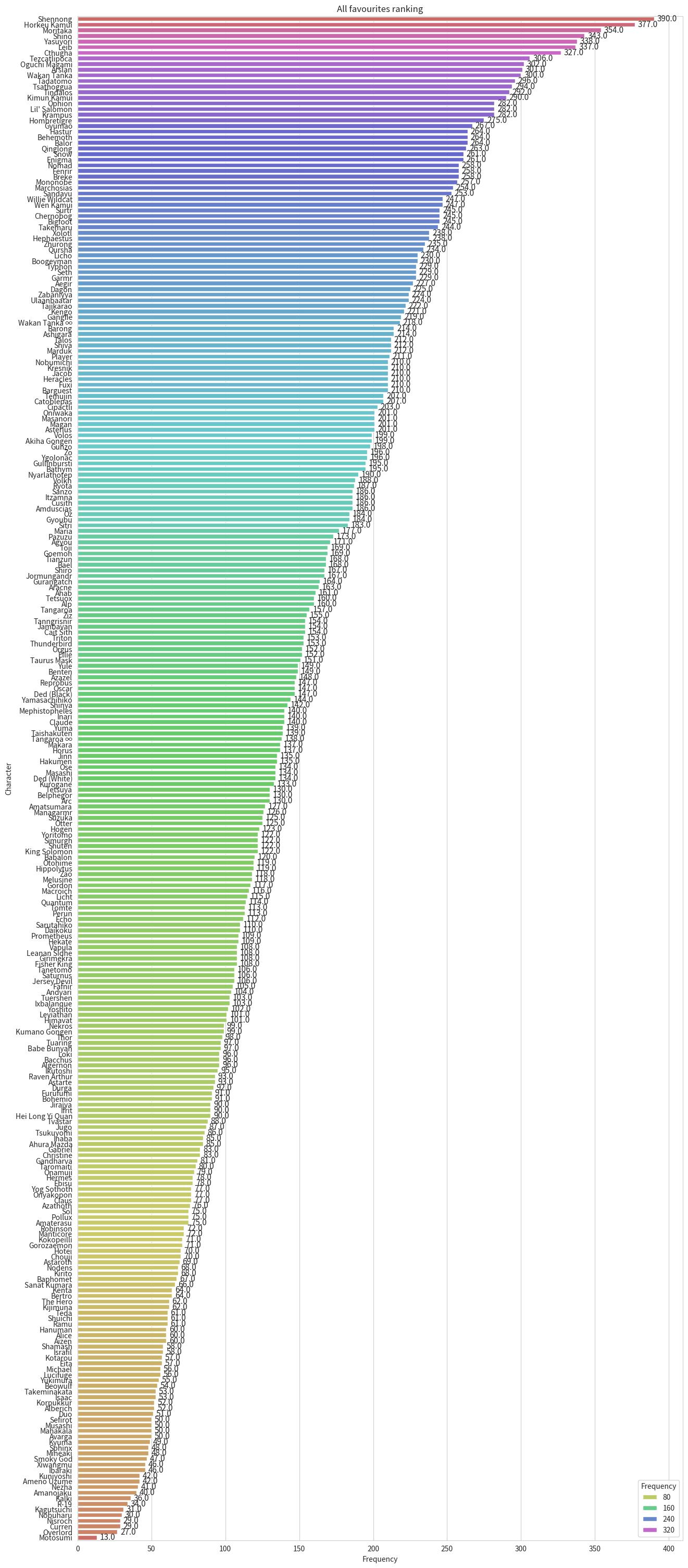

Disclaimer:

I am terribly sorry that I forgot to add

Bigfoot and

Motosumi when the survey was first published. The first mistake was rectified during the same night when we had received around 100 responses, but the second mistake was only rectified when we had already received around 500+ responses.

Therefore, these two characters may be receiving slightly less votes than they should have if I did not make those mistakes.

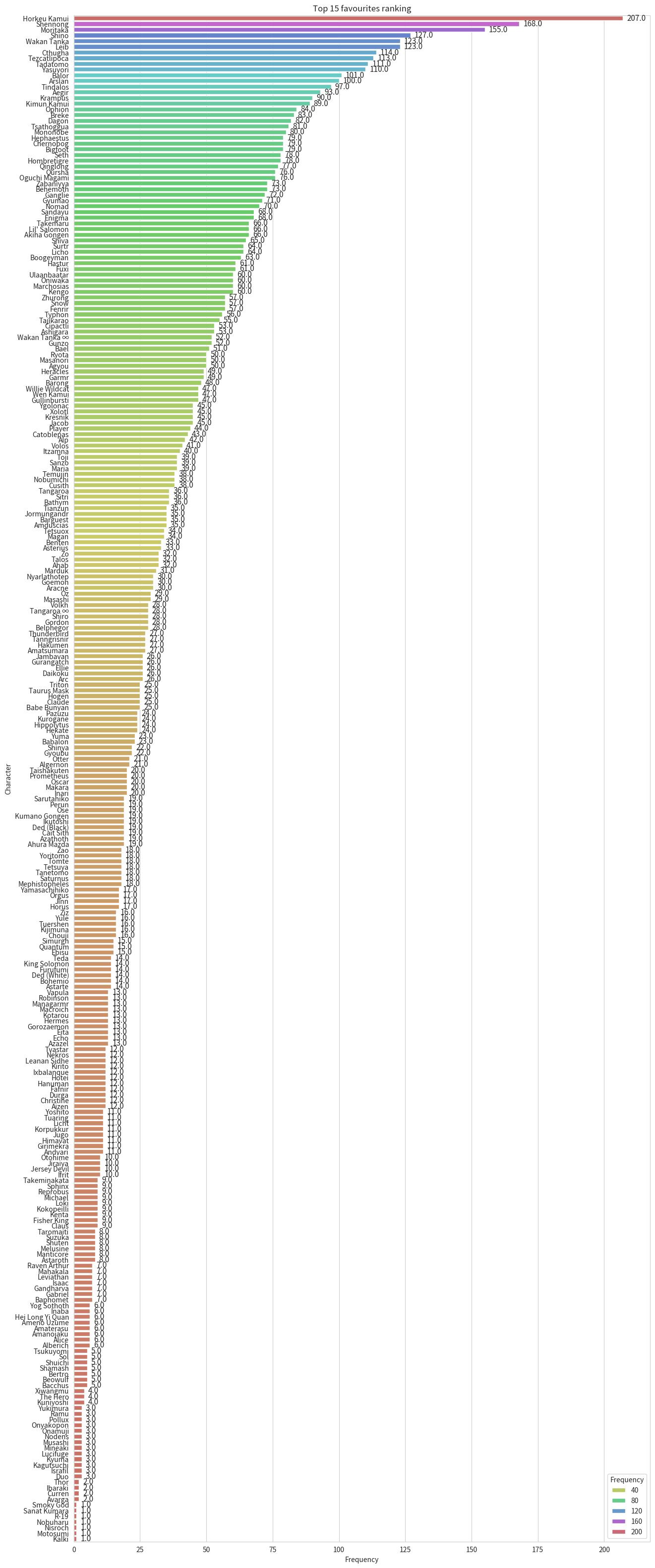

Top spots for “All favourites” popularity ranking for each category

| Male furry | Vote | Male human | Vote | Female/Other | Vote |

|---|---|---|---|---|---|

| 390 | 300 | 177 | |||

| 377 | 264 | 163 | |||

| 354 | 257 | 155 | |||

| 343 | 253 | 152 | |||

| 338 | 245 | 149 |

Comments

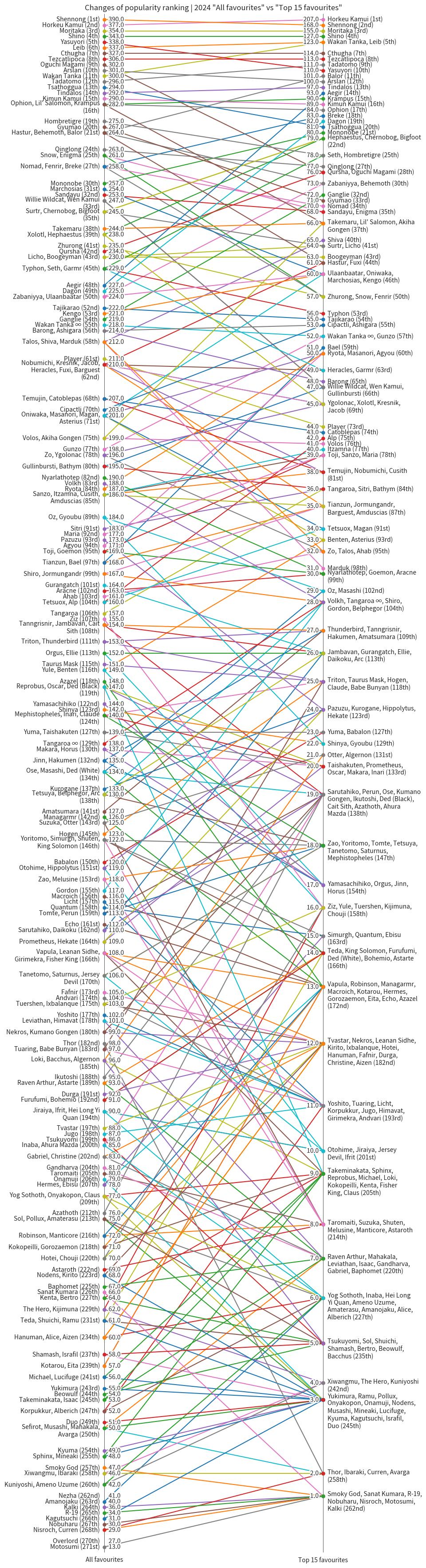

- Once again, male furries dominated the popularity poll

Shennong and

Shennong and  Horkeu Kamui took the first and second place respectively in “All favourites” ranking, but their order is reversed in “Top 15 favourites” ranking with a significantly wider gap.

Horkeu Kamui took the first and second place respectively in “All favourites” ranking, but their order is reversed in “Top 15 favourites” ranking with a significantly wider gap.- In the first 20 characters in “Top 15 favourites” ranking, human characters like

Wakan Tanka,

Wakan Tanka,  Balor,

Balor,  Aegir and

Aegir and  Dagon receive some significant boost in ranking.

Dagon receive some significant boost in ranking.  Aegir climbs up by a lot

Aegir climbs up by a lot

- Younger characters like

Eita,

Eita,  Babe Bunyan and

Babe Bunyan and  Sphinx receive some of the largest boost in ranking from “All favourites” to “Top 15 favourites” ranking.

Sphinx receive some of the largest boost in ranking from “All favourites” to “Top 15 favourites” ranking.

You might want to put a ruler on your screen to follow the lines in the chart below…

Just for fun, let’s compare the votes for some famous doppelgangers:

All favourites

| Character 1 | Vote | Character 2 | Vote |

|---|---|---|---|

| 221 | 201 | ||

| 354 | 343 | ||

| 257 | 122 | ||

| 290 | 247 | ||

| 377 | 188 | ||

| 134 | 147 | ||

| 104 | Alberich | 52 | |

| 229 | 168 | ||

| 69 | 93 | ||

| 153 | 225 | ||

| 238 | 212 | ||

| 224 | 58 | ||

| 96 | 99 | ||

| 184 | 196 | ||

| 300 | 218 | ||

| 157 | 138 |

Top 15 favourites

| Character 1 | Vote | Character 2 | Vote |

|---|---|---|---|

| 60 | 60 | ||

| 155 | 127 | ||

| 80 | 14 | ||

| 89 | 47 | ||

| 207 | 28 | ||

| 14 | 19 | ||

| 11 | Alberich | 6 | |

| 78 | 51 | ||

| 8 | 14 | ||

| 25 | 82 | ||

| 79 | 32 | ||

| 73 | 3 | ||

| 5 | 12 | ||

| 29 | 32 | ||

| 123 | 52 | ||

| 36 | 28 |

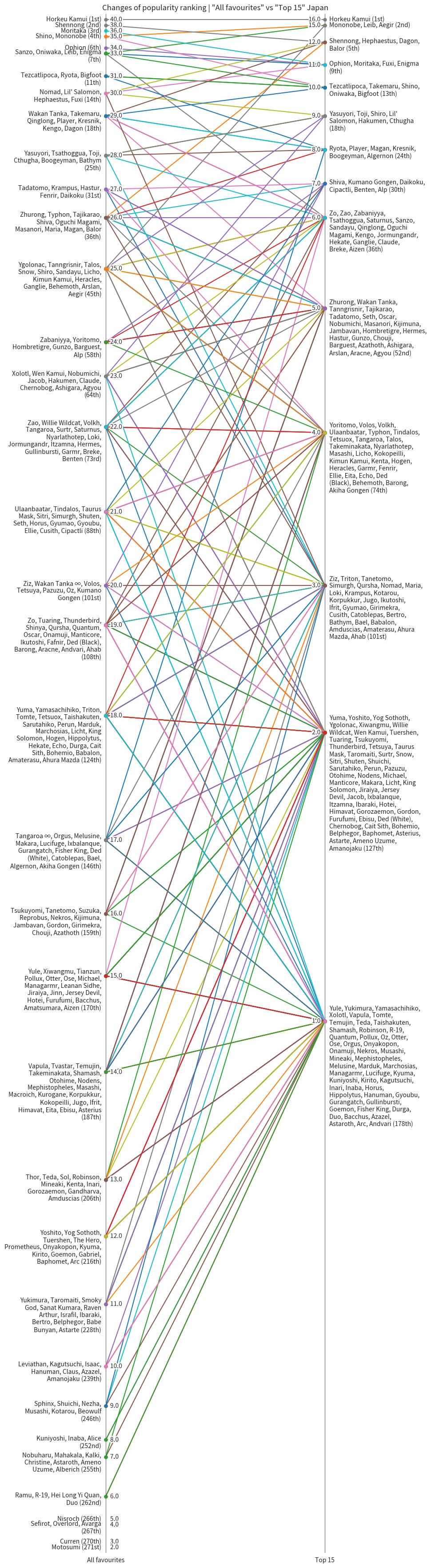

Japan

- With 76 Japan respondents, it is clear that Japan playerbase are also mostly furry-lovers.

Horkeu Kamui,

Horkeu Kamui,  Shennong and

Shennong and  Moritaka

Moritaka Mononobe is very high in Japan’s “Top 15 favourites” compared to the global ranking.

Mononobe is very high in Japan’s “Top 15 favourites” compared to the global ranking.

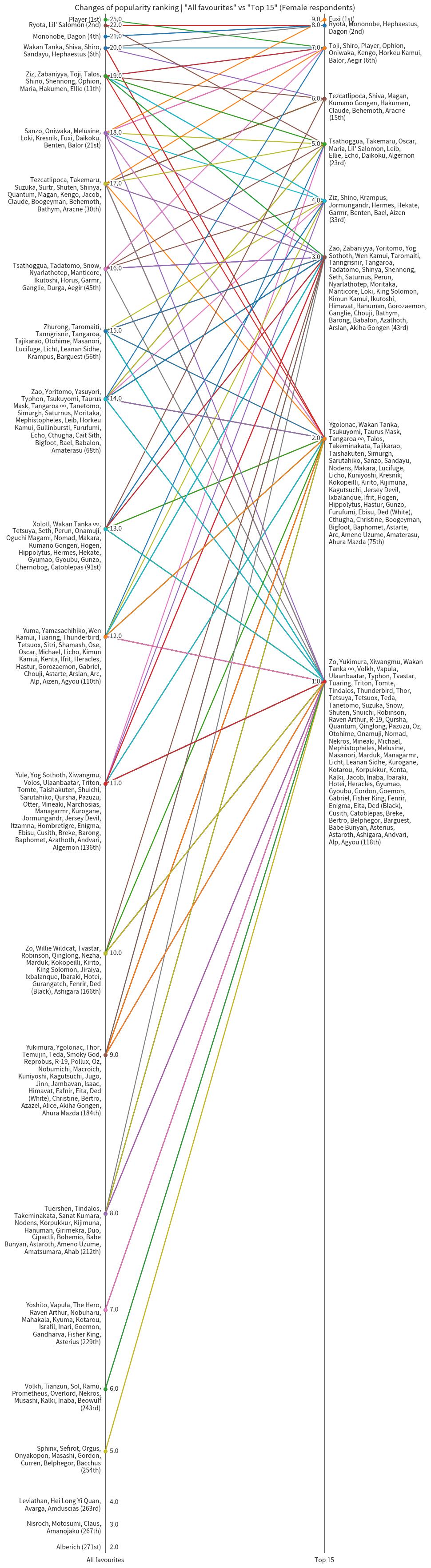

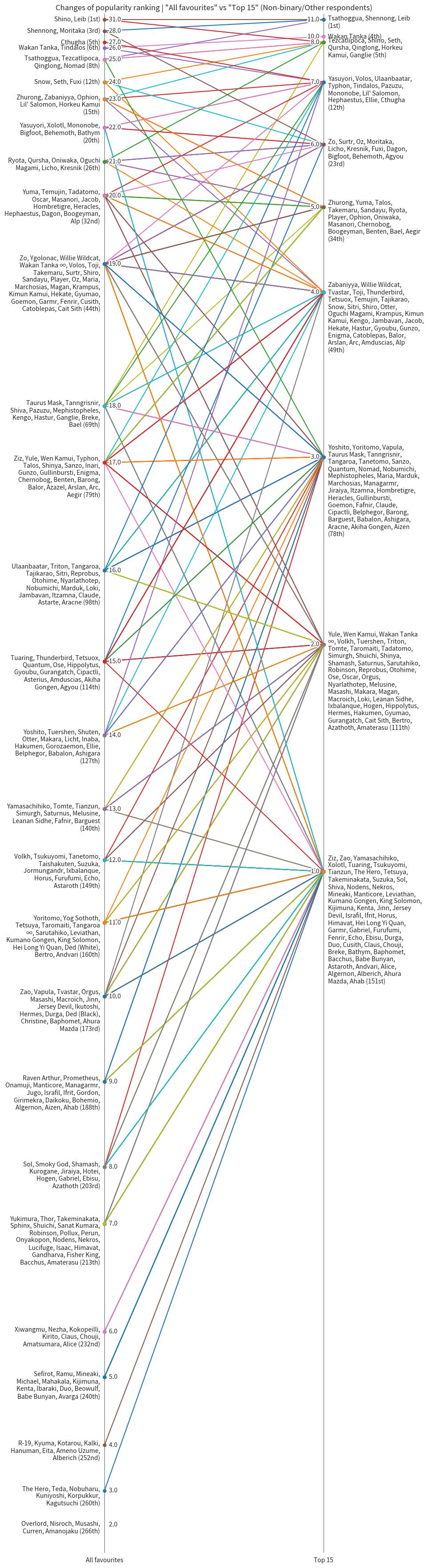

Female / Non-binary / Other respondents

- The number of non-male respondents is small to begin with, so there are a lot of ties in votes.

- It seems that female respondents are also pretty into muscular male furries and mature-looking male humans.

Protagonist took the first place in “All favourites”

Protagonist took the first place in “All favourites”- The top 5 of female respondents’ “Top 15 favourites” contain some characters that are very different from the global ranking:

Fuxi,

Fuxi,  Ryota and

Ryota and  Hephaestus

Hephaestus

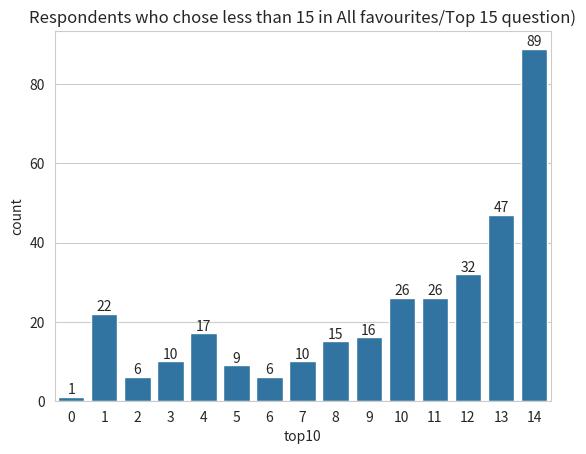

People with less than 15 favourites

In this gacha game that is full of baits for thirsty players, let us applaud these people who can limit the amount of characters they devote their hearts for.

Free form questions

For the next two questions, the volume of the feedback is simply too big for me to go through one by one, so I used ChatGPT to summarize them (and even then I had to do it in a few batches because the total text length exceeds ChatGPT’s limit…)

The “number of mentions” should be treated more as an estimation rather than absolute value. Words coloured in blue are my own.

Full set of user feedback in Google Sheet

Because there are respondents who clearly spent at least half an hour to write some of the feedback, I think only publish AI summary by ChatGPT would be an injustice, so I am also putting the full set of user feedback here:

What People Like about the Game

- Character Designs And Art (459 mentions)

- Diverse Body Types and Representation: Players appreciate bara, furry, chubby, fat-positive and muscular character designs.

- Appealing Artwork and Illustration Styles: Talented artists’ designs and vibrant visuals are frequently praised.

- Character Development and Personalities: Unique personalities, emotional backstories, and growth arcs are well-received.

- Representation and Inclusivity: LGBTQ+ themes and diverse gender/body types make the game stand out positively.

- Favorite Characters and Artists: Specific mentions of characters like Garmr, Horkeu Kamui, and Kengo, as well as admiration for featured artists.

- Storytelling and Lore (283 mentions)

- World-Building and Lore: Players love the mythological references and deep narratives with philosophical and social commentary.

- Emotional and Thought-Provoking Themes: Stories evoke strong emotions and encourage reflection.

- Character Relationships and Bonds: Meaningful interactions with the protagonist and between characters are highlighted.

- Mystery and Fantasy Themes: Urban fantasy mixed with magical and mythological elements is praised.

- Interesting comments:

- “The game handles heavy themes without becoming overwhelming, blending personal struggles and philosophy beautifully.”

- “I love exploring ‘what-if’ scenarios through events!” “The world-building is so unique; it deserves an anime adaptation.”

- Inclusivity and Representation (149 mentions)

- LGBTQ+ Themes and Romance Options: Support for gender expression and inclusivity, including the ability to choose gender identity for the protagonist.

- Diverse Mythological and Cultural Influences: The game incorporates mythologies from various cultures, adding richness to the narrative.

- Gameplay Mechanics (106 mentions)

- Simple Yet Strategic Combat: Mechanics are easy to learn but offer complexity for veterans.

- Team Building and Customization: Flexible strategies and character synergies keep battles interesting.

- Farming and Progression: Players appreciate that grinding is minimal compared to other gacha games. Short playtime and manageable stamina system.

- Interesting comments:

- “The difficulty scaling and teambuilding challenge me without feeling unfair.”

- “Not having to grind constantly is a huge relief.”

- Voice Acting and Music (86 mentions)

- Voice Acting: Strong performances add emotional depth to characters.

- Music: Recognized for memorable tracks, especially from 2019–2022.

- Accessibility and Community Appeal (41 mentions)

- Casual Gameplay: Appeals to players who prefer light engagement without time constraints.

- Community and Fan Content: Fans appreciated LifeWonders’ support of derivative works and fan art.

- Low Pay-to-Win Pressure: Few complaints about aggressive monetization.

- Emotional Connection and Social Impact (19 mentions)

- Personal Investment in Characters: Players form deep emotional connections with their favorites.

- Community and Friendships: The game fosters a sense of belonging and provides comfort.

- Interesting comments:

- “Housamo makes up for the lack of friends I never had in real life.”

- “I feel attached to the characters like they’re part of my life.”

What Improvements People Want in the Game

- Pity/Spark System for gacha (376 mentions)

- Pity System for Gacha – Strong demand for a pity/spark system to guarantee rare units after a set number of pulls.

- Improved rates and rewards for duplicate pulls (e.g. trading duplicates for resources like Rainbow Shards).

- Frustration with inconsistent gacha rates and lack of guarantees for desired units, especially during limited-time banners.

- Suggestions to introduce pity even for rerun banners

- Paid-stone banners to cater to paying players.

- Requests to make selector tickets available (allowing players to pick specific 5-star units).

- Comparison to LifeWonders’ other game, Live A Hero, which has a pity system, leading to demands for similar mechanics in Housamo.

- More free gacha stones and tickets through challenges, events, or daily/weekly bonuses.

- More affordable microtransactions.

- Suggestions to introduce a monthly card subscription for consistent rewards.

- Faster and Complete translation (301 mentions)

- Faster Translations – Many want quicker and complete translations of main stories and event stories.

- Translation for date quests and character quests

- Real-time Translations – Players want synchronized updates for translated content rather than delays.

- Multi-language support – there are requests for Thai, Korean and Spanish translation

- Gameplay Improvements (254 mentions)

- Combat Rework – Requests for a smoother, faster, and less grindy battle system with auto-play, auto-clear, and skip functions for farming quests.

- Improved Difficulty and Challenges – More high-difficulty quests like Tower of Babel and Crisis Quests with added restrictions, mechanics, and rewards.

- Strategic Depth – Players seek mechanics like weapon resistances, specific formation requirements, and multi-phase boss battles to make combat more engaging.

- Unit Balancing – Older units need buffs, evolutions, or new skills to stay relevant.

- Events and Re-runs – Frequent reruns of older events and banners, especially for limited characters.

- Endless challenges (similar to “Towers” in other games).

- Roguelike dungeons inspired by Live A Hero.

- Special battles that limit overpowered strategies to encourage creative team-building.

- User Interface (UI) And Quality-of-Life (QoL) Updates (209 mentions)

- Loading speed of story and entering battle

- Adding skip buttons for farming stages and story segments.

- Hold-to-skip feature will speed up/skip animations too

- Increase the friend limit to 100

- Jukebox/playlist initiated on boot

- Allow using more than one stamina drinks in one go

- Official tips/guides for hard content

- Reducing grind times by implementing auto-clear tickets for repetitive battles.

- Streamlining inventory management and artifact systems for easier navigation.

- Introducing in-game encyclopedia/glossary to explain mechanics and story terms.

- Expanded Customization – Portrait mode and guild upgrades like in Live A Hero.

- More skins, outfits, and MC customization options.

- Suggestions to add double-reward events to incentivize farming without excessive stamina use.

- Inclusion of multi-summon options for ally points or low-rank summons to save time.

- Easier ways to earn coins, level seeds, and materials.

- Lower costs for upgrades and leveling up characters.

- Visual and Animation Update (94 mentions)

- Desire for animated battle sprites or Live2D/3D models, similar to Live A Hero.

- Criticism of static character portraits in combat, calling for more dynamic attacks and visual effects.

- Requests to improve attack animations and special effects to make battles feel less outdated.

- Suggestions for adding CG illustrations or short animations during key story moments to improve immersion.

- Story and Lore Enhancements (180 mentions)

- More engaging and easier-to-follow narratives.

- I myself have decided to turn off my brain when reading Main Quest these days

- Characters need more character growth

- Older characters rarely get used.

- Stories are bloated with too many characters.

- Some cameos added “just to show off the new swimsuit skins of 10+ characters” or “because these characters are from the same school / guild / affiliation” feel very forced if they are not plot-relevant, and that just makes the segment feels very boring. It really depends on the writer’s skill.

- New characters’ personalities feel like rehashed of old characters’ personalities

- To be completely fair, this game has > 270 characters. There are bound to be some overlapping in character traits.

- Requests for keyword glossaries to simplify complex terms.

- Additional visual content (CGs, short movies) for storytelling.

- More frequent story updates and date quests.

- More engaging and easier-to-follow narratives.

- Better Character Representation (103 mentions)

- Demands for greater body type variety—more average physiques, smaller frames, and softer features to balance the emphasis on buff or chubby designs.

- New and Varied Cast – More older men, bara, furry designs, and diverse races (e.g., horse, bat therian).

- Some requests to remove underage/shotacon characters

- I think what we really need is, stop giving revealing clothes to underage characters!!

- Account Management Features (15 mentions)

- Email or SNS-linked accounts for better security and recovery options.

- Multi-device support.

- Bug Fixes and Optimization (25 mentions)

- Faster load times, smoother performance, and fixes for bugs like skill descriptions cutting off.

Some unique requests:

- Sexual Content Options – Adult content toggles. More adult content, including nudity and explicit interactions.

- PvP Mode – Mixed opinions (14 mentions), but some players want balanced PvP mechanics.

- Music and Sound Effects – Customizable jukebox playlists and better dungeon music loops.

- Lore Tracking System – Requests for summaries, glossaries, and timeline features to follow complex storylines.

- Customizable AR Equipment – Ability to equip multiple ARs and experiment with new skill mechanics.

- Interactive Guilds – Borrowing mechanics from Live A Hero’s Office, including gifts and rewards based on guild rank.

- Social Features – Options for friend communication, support lineup expansion, and team suggestions for harder quests.

- Returning NPCs – Bringing back old NPCs (e.g. Parvati) in reruns or alternate versions.

- Voice Line Subtitles - Adding captions to dialogues to help players who can’t understand Japanese.

- Mini-Games and Side Content - Additional interactive content to make the game feel less repetitive.

- Story Branching - Options for different endings or alternative story paths.

Afterword

I hope you enjoy reading this report. I had wanted to run such survey for Housamo for a while, but never actually commit it until this year. The final straw was when a Discord server I am in kind of collectively think that ![]() Manticore isn’t popular, but he seems to be quite well-received in other circles, so I wanted to gather data from a wider sample group to see beyond the echo chamber effect.

Manticore isn’t popular, but he seems to be quite well-received in other circles, so I wanted to gather data from a wider sample group to see beyond the echo chamber effect.

Manticore is placed at 216th in global “All favourites” ranking and 108th in Japan “All favourites” ranking. He also sit at 45th in female-only respondents’ “All favourites” ranking. He currently only appears in story without official translation, so it is not very surprising that he does not do well in global circle.

To reduce my burden, I deliberately reduced the number of questions in this survey, yet it still took me weeks to compile this report. In hindsight, removing the feedback question for the survey itself was kind of a mistake too.

Anyway, see you in next year survey!

Data sanitization

I put this at the end because I know most people will find this boring, but given the sample size, it is not surprising that we might have responses that look suspicious. I will talk about some of the measures I took to sieve the responses.

Suspicious responses

- A transgender girl from Antarctica, has JLPT N1 level but does not play the game, and requested an English translation for the game.

- What is the probability that this combination actually exists in the world?? How many people were born in Antarctica, some more being a transgender? If you have achieved JLPT N1 level, you probably can play the game and read its story without English translation. This response was submitted after I had already added clarification on JLPT levels and other standardized Japanese language tests, the person clearly did not read the questions properly.

- Someone born in North Korea and is 5000 years old this year. If the person claims to be born in North Korea but has a more believable age, I might have kept it there.

Removing duplicate responses

Surprisingly, I actually did not find much duplicate responses this time.

People just don’t read instructions!

For optional questions, please leave them blank if you have no comment, and I specifically said “don’t write N/A”, yet I still get some “N/A”, “No”, “None” and their equivalent in other languages for those questions.

For the “when did you start playing Housamo” question, despite already stating that the game launched on 2 December 2016, there are still people who claim to have played the game before this date, some even as far back as the year 1998.